Is your enterprise struggling to bridge the gap between decades-old IT and cutting-edge blockchain?

By 2025, the global enterprise blockchain market is projected to be worth over $1.4 trillion, with North America leading this growth.

This isn’t just a tech trend; it’s a competitive arena. Integrating blockchain isn’t about replacing your core systems, but enhancing them—especially through blockchain development in USA—turning compliance from a cost into a strategic advantage

Table of Contents

Introduction: The Challenge of Integrating Blockchain in Enterprise Systems

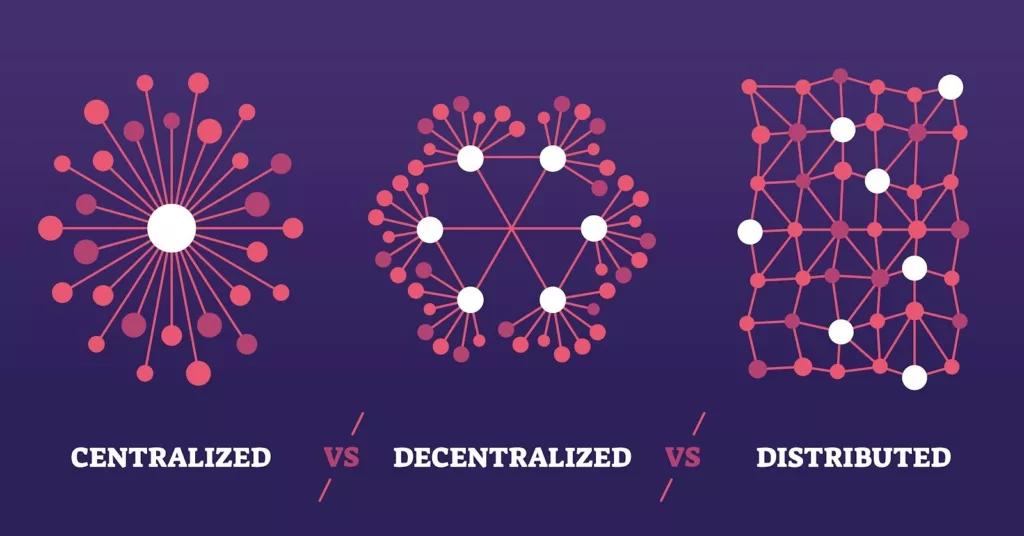

The modern enterprise is caught in a paradox. On one hand, blockchain and Distributed Ledger Technologies (DLT) have emerged as a powerful new way to build systems based on cryptographic trust, immutable transparency, and decentralized efficiency. On the other hand, the global economy is built upon decades-old legacy IT infrastructure that is fundamentally incompatible with these modern networks.

This “legacy barrier” is the single biggest technical challenge holding back true enterprise adoption, especially in the United States. These core systems—often found in banking, insurance, and healthcare—are defined by problematic architectural characteristics:

- Monolithic Design: The user interface, business logic, and data layer are all intertwined, making updates risky and integration perilous.

- Archaic Programming Languages: Many core operations still run on languages like COBOL, which lack support for the modern API frameworks needed to connect to a blockchain.

- Rigid, Siloed Databases: Data is locked in proprietary formats and fixed schemas, creating “information silos” that are complex and error-prone to migrate.

- Limited API Interfaces: These systems were built before the API-first paradigm. Any attempt to connect them requires custom-built connectors, leading to a brittle, unmanageable tangle of “spaghetti integration.”

The Trifecta of Barriers

This integration hurdle creates a “trifecta” of deeply linked challenges for any U.S. business:

- The Technical Barrier: The fundamental incompatibility of system architectures, data formats, and security protocols.

- The Economic Barrier: A “rip and replace” strategy is a false choice. Enterprises have invested billions in these legacy systems. The high cost of simply coexisting with them is a primary barrier to adopting new technology.

- The Human Barrier: Successfully bridging this technical gap requires a “rare and specialized skillset.” A widespread “shortage of skilled personnel” means most companies simply do not have the internal talent to solve this problem.

This establishes the central reality for the next era of enterprise technology: the debate is not “legacy vs. blockchain” but “legacy and blockchain.” The future lies in “upgrading” the utility of legacy systems through DLT integration.

The “Trust Paradox”

This situation creates a central “Trust Paradox” for enterprise adoption.

- The Problem: Legacy systems are defined by their vulnerabilities. They are susceptible to cyberattacks, prone to human error, and suffer from data mismanagement. The situation is so severe that 40% of CFOs express doubts about the accuracy of their own financial records.

- The Solution: Blockchain’s entire value proposition is the antidote to this. It provides “trust,” “immutability,” and “tamper-proof” records.

- The Paradox: The very systems that create the urgent need for blockchain’s trust are the primary technical and economic barriers to its implementation.

The market, therefore, does not just need a new technology; it needs a translator or intermediary—a solution that can graft blockchain’s trust onto a legacy system without destroying the business process it supports.

What This Means for Your Blockchain Project

This analysis leads to four critical implications for any U.S. enterprise considering a blockchain initiative:

- Your strategy must be “Integration,” not “Replacement.” A “rip and replace” approach to your core legacy systems is financially and operationally unfeasible. Your project’s success depends on a hybrid architecture that seamlessly connects your existing, stable systems to a new blockchain layer.

- The project is a governance challenge, not just a tech problem. The “Trust Paradox” cannot be solved with code alone. You must first get your internal and external stakeholders (suppliers, partners, etc.) to agree on a common set of rules, data standards, and governance. This political and business-process alignment is the true first step.

- Your choice of partner is the single most important decision. You cannot execute this project with a traditional IT vendor or a “blockchain-only” startup. You require a strategic partner who is a “translator”—a firm with the “rare and specialized skillset” that is equally fluent in modern blockchain architecture and the realities of complex legacy enterprise systems.

- You must start with a small, high-value pilot. Given the high cost, technical complexity, and human barriers, a “big bang” rollout is a recipe for failure. The correct approach is to identify a single, high-impact problem (like traceability for one product line or verifying one type of document) and build a pilot to prove the ROI of the “trust layer.” This de-risks the investment and builds the internal case for a larger-scale deployment.

Comparative Analysis of Enterprise Systems

| Feature | Traditional Legacy Systems | Blockchain-Integrated Systems |

| Data Structure | Siloed, rigid databases, proprietary formats | Unified, shared, “single source of truth” |

| Data Integrity | Vulnerable to manipulation, error-prone manual entry | Immutable, tamper-proof, high-integrity |

| Transparency | Opaque, “information silos” | Transparent, shared ledger for all permissioned parties |

| Auditability | Costly, manual, post-facto, unreliable records | Real-time, automated, immutable audit trail |

| Security | High vulnerability, difficult to secure | Cryptographically secure, decentralized, resilient |

| Process Automation | Manual, redundant, error-prone workflows | Automated via smart contracts, reduced intermediaries |

Why Integration Matters for US Businesses

For U.S. businesses, integrating blockchain with existing legacy systems is not just a defensive IT upgrade; it is an “offensive strategy for growth” and a measure of a company’s “competitive agility” in a demanding market.

The business case for integration is built on market momentum, strategic necessity, and the powerful, tangible advantages it unlocks.

The $1.4 Trillion Competitive Arena

This is not a niche technology. The global enterprise blockchain market is projected to be worth over $1.4 trillion by 2030, expanding at a staggering 90.1% compound annual growth rate (CAGR) from 2025 to 2030.

Critically, North America dominated this global market in 2024, accounting for the largest revenue share at 37.4%. This growth is fueled by massive venture capital inflows and high enterprise demand for secure, transparent, and efficient transactions. For a U.S. business, this is not a trend to watch; it is the new competitive arena.

The “Add-On” Advantage: Enhancing, Not Replacing

Perhaps the most important business case for U.S. companies is that integration preserves and enhances their massive, multi-billion-dollar investments in legacy infrastructure.

A “rip-and-replace” strategy is a false choice. As analysts from Deloitte have noted, blockchain does not “displace a company’s legacy systems.” Instead, it “can serve as an add-on enterprise solution that increases value while still maintaining existing enterprise resource planning (ERP) software systems.”

This “bolt-on” model is the key. It allows a U.S. business to add the 21st-century benefits of blockchain—provable trust, immutable ledgers, and smart contract automation—to their 20th-century core systems without the risk and cost of a “rip-and-replace” catastrophe.

Unlocking Tangible Advantages

This integration strategy creates immediate, offensive advantages that drive growth and efficiency.

- Reduced Operational Costs: Integration provides a direct, hard ROI by automating manual, error-prone processes and eliminating the need for costly intermediaries in areas like payment processing and contract management.

- Superior Customer Experience: Disconnected legacy systems lead to a fragmented customer experience. Integration creates a “single source of truth” and a “unified view of your customers,” enabling faster, more personalized service that builds long-term loyalty.

- New Business Models: This provides the platform for future growth, enabling new, digital-native paradigms that are impossible with legacy systems alone, such as the tokenization of real-world assets (e.g., real estate, securities) or the creation of trusted digital ecosystems with your partners.

Flipping Compliance from a Cost to a Weapon

In the highly regulated U.S. market, compliance is a massive cost center that relies on expensive, manual, and reactive audits. Blockchain integration flips this dynamic.

As highlighted by Thomson Reuters, the transparent and real-time on-chain data generated by blockchain systems allows firms to turn compliance “from a cost center to a competitive advantage.” The cryptographic proofs and automation allow for proactive, real-time compliance, freeing up resources and providing a level of assurance that legacy systems can never match.

The true value of integration is not just connecting two systems; it is about creating an entirely new and superior data value chain. This integration feeds the deep, historical data from your legacy systems into the immutable, transparent, and verifiable blockchain ecosystem. This fused data is more valuable than the sum of its parts. It creates an asset that is both deep (from legacy) and trustworthy (from blockchain), allowing your business to make “faster, smarter decisions than your rivals.”

Vinova’s Approach – Hybrid Architecture and Middleware Solutions

We understand that bridging the gap between your legacy systems and modern blockchain technology demands a “rare and specialized skillset.” As an award-winning ICT solutions company with over 15 years of experience, we are that specialist partner.

Our extensive portfolio of enterprise-level clients, including “giants” like Samsung, PwC, Abbott, and OCBC Bank, validates our ability to handle complex, high-stakes technology projects. Our solution is not a single product but an integrated methodology built on two core pillars: deep expertise in system integration and an enterprise-first approach to blockchain.

Pillar 1: Middleware as the “Universal Translator”

Our foundation is our deep expertise in “System Integration Services.” We are specialists in connecting the disconnected platforms—such as ERP, CRM, and logistics software—that run your business. This approach allows us to immediately avoid the brittle, high-risk “spaghetti integration” that results from simple, direct connections.

Instead, we employ middleware as the “universal connector” or “bridge” between the old and the new. This middleware layer acts as a “universal translator” that “decouples” your legacy system from the blockchain’s internal workings. This decoupling is the key to a safe and successful project for several reasons:

- Risk Mitigation: It allows for phased, gradual rollouts. Instead of a high-risk “big bang” switchover, we can bring new blockchain-enabled functions online one by one, minimizing disruption to your core business operations.

- Maintainability: The layered architecture simplifies updates and allows for “plug-and-play upgrades.” If you want to upgrade your blockchain protocol or change a legacy component, the middleware layer absorbs the change so the entire system doesn’t break.

- Data Transformation: The middleware layer handles the crucial task of translation. It can take proprietary data formats from a rigid legacy database and reformat them into modern, blockchain-compatible data structures, ensuring smooth communication.

Pillar 2: Hybrid Architecture for Enterprise-Grade Control

Our blockchain services are explicitly “enterprise-focused.” This is a critical distinction from public cryptocurrencies. We specialize in permissioned, enterprise-grade frameworks like Hyperledger Fabric and Corda. This approach is fundamental because it ensures that you “maintain necessary control over data,” a non-negotiable requirement for any regulated U.S. business.

The core of our technical solution is a “Hybrid Architecture.” This is purpose-built to solve the primary enterprise challenges of privacy and scalability through a sophisticated “On-Chain / Off-Chain” data model:

- Off-Chain: All your sensitive, high-volume, or proprietary data—such as customer PII, patient records, or detailed financial figures—remains securely in your existing, access-controlled legacy systems.

- On-Chain: The blockchain (e.g., Hyperledger Fabric) stores only an immutable proof of that data. This proof is typically a cryptographic hash (a unique digital fingerprint), a timestamp, or a record of a specific event (e.g., “KYC Verified,” “Shipment Received”).

This L1-L2 hybrid configuration is the key. It “leads to privacy while at the same time maintaining immutability, decentralization, and auditability.”

Our Solution to The “Trust Paradox”

Our integrated methodology is the synthesis of these two pillars. We leverage our middleware expertise to safely extract data events from your legacy systems and translate them. Then, our hybrid blockchain architecture records and verifies those events in a way that is secure, private, and scalable.

This directly solves the “Trust Paradox”—the conflict between blockchain’s total transparency and your enterprise’s absolute need for data privacy, especially under U.S. regulations like HIPAA or SOX.

Our hybrid, on/off-chain model is the elegant solution. It is a “privacy-preserving bridge” that allows your enterprise to gain the full benefits of blockchain’s immutability and auditability (the “on-chain” proof) without exposing your sensitive data (the “off-chain” asset). This is the only way a regulated U.S. bank or hospital can realistically adopt this technology.

We are not just selling “blockchain”; we are delivering “compliance-native, privacy-preserving integration.”

Our Integration Methodology: Challenges and Solutions

| Legacy System Challenge | Integration Risk | Our Solution (Middleware/Architecture) |

| Rigid, Monolithic Architecture | System-wide failure; inability to update | Middleware Decoupling: Isolates systems, enabling phased, safe rollouts and “plug-and-play” upgrades. |

| Limited/Proprietary APIs | Data silos, costly “spaghetti integration” | Modern API Layer / ESB: Creates a clean, standardized “universal connector” for seamless data flow. |

| Data Privacy / Confidentiality | Violation of U.S. regulations (HIPAA, SOX) | Hybrid On/Off-Chain Architecture: Sensitive data stays off-chain; immutable proof is stored on-chain. |

| Need for Enterprise Control | Loss of governance on public chains | Permissioned Frameworks: Use of Hyperledger Fabric and Corda to ensure control over data and participants. |

| Scalability & Cost | Slow, expensive transactions; network congestion | L1-L2 Hybrid Configuration: High-volume transactions are processed off-chain (L2) for speed; final settlement occurs on-chain (L1). |

Use Case – Financial Institution Blockchain Integration

The financial services industry is the ultimate proving ground for enterprise blockchain integration. It’s an industry that perfectly embodies the central challenge: its core operations often run on “decades-old technology,” yet it faces the most extreme regulatory scrutiny (SEC, SOX) and the highest risk of sophisticated fraud.

This high-stakes environment is the ideal case study for our high-trust, high-compliance, integration-first solution. We enable financial institutions to move beyond concepts and actively deploy blockchain solutions to address their most persistent challenges.

The Problems We Solve for U.S. Financial Firms

We have the expertise to build solutions for the primary use cases in U.S. finance:

- Cross-Border Payments & Settlements: This process is notoriously slow and expensive. We build blockchain solutions that can reduce settlement times from days to minutes and cut operational costs by enabling direct, peer-to-peer (P2P) transactions.

- Know Your Customer (KYC): Banks spend billions on redundant KYC checks. We can help build a secure, decentralized identity system, allowing customer information to be verified once and then securely shared (with permission) across institutions to streamline compliance.

- Fraud Prevention: We use blockchain’s immutable, cryptographically-secure ledger to provide an unparalleled tool for fraud prevention. We create a permanent, unalterable record of all transactions, making it nearly impossible for fraudsters to manipulate data.

- Asset Tokenization: We build platforms to convert real-world assets—such as real estate, bonds, or commercial paper—into digital tokens on a blockchain, increasing liquidity and streamlining trading.

How We Prove Our Expertise: The OCBC Model

Our credibility in this demanding sector is established by our enterprise-grade client portfolio, which includes financial and insurance “giants” like PwC, AIA, and OCBC Bank.

While our specific engagements are proprietary, the public-facing blockchain initiatives of our client, OCBC Bank, are a powerful illustration of the exact type of high-stakes, enterprise-grade integration we are built to enable.

These are not trivial projects; they are mission-critical digital transformations:

- Digital Asset Tokenization: OCBC established a US$1 billion digital US commercial paper (USCP) programme using blockchain technology. This project digitizes a traditional, high-value financial instrument, requiring a platform that is secure, compliant, and capable of handling immense value.

- Core Liquidity Management: OCBC is collaborating with J.P. Morgan’s blockchain-based Digital Financing platform for “intraday repo.” This allows the bank to engage in the “intraday borrowing and lending of cash” in real-time to optimize its balance sheet.

These use cases are the perfect validation of the “add-on” integration model. A bank like OCBC cannot and will not “rip and replace” its core ledger. To launch a $1 billion digital commercial paper program or an intraday lending facility, it must build new, innovative blockchain solutions that connect seamlessly and securely to its existing legacy ledgers and regulatory reporting frameworks.

This is precisely the complex, high-stakes integration challenge that demands a specialist partner. Our documented status as a trusted partner to OCBC, combined with our mastery of the “rare skillset” for system integration and our explicit expertise in enterprise-grade frameworks like Hyperledger and Corda, positions us as the ideal enabler for your financial-grade transformation.

Benefits – Transparency, Compliance, and Scalability

When we integrate blockchain with your legacy systems using our hybrid, middleware-driven approach, the benefits are not abstract. They are tangible, enterprise-grade solutions to the three most pressing challenges your U.S. business faces: transparency, compliance, and scalability.

Our Solution’s Benefits: Transparency, Compliance, and Scalability

1. Transparency: Creating a “Single Source of Truth”

Our integration provides a shared, distributed, and transparent ledger where all permissioned parties have access to the exact same data, at the same time. This creates an immutable, timestamped record of all transactions, which definitively solves the “information silo” problem that plagues most organizations. In your supply chain, this provides “digital provenance,” allowing you to prove the origin and track the real-time movement of goods.

However, we understand that for a U.S. enterprise, total transparency is a liability, not a benefit. A bank cannot make all its transaction data public, and a hospital cannot expose patient data.

This is where the nuance of our hybrid architecture becomes the central benefit. The “transparency” we deliver is selective transparency.

- On-Chain (Public Proof): We allow parties to be transparent about a shared event by viewing its immutable proof on the blockchain (e.g., “KYC check complete,” “Payment settled,” “Product scanned at port”).

- Off-Chain (Private Data): The confidential data underlying that event (e.g., the customer’s PII, the payment amount, the product’s cost) remains secured, private, and off-chain in your legacy system.

This is “transparency for auditability” without a “breach of confidentiality”—a crucial distinction that makes the technology viable for your business.

2. Compliance: Automation and Immutability for U.S. Regulation

Our solutions are explicitly “designed to meet the specific regulatory needs of the U.S. market,” including FDA rules for traceability, HIPAA for patient data, and SEC/SOX for financial reporting. We deliver this benefit in two forms:

- Passive Compliance (The Immutable Audit Trail): The immutable ledger we build is, by itself, an unalterable, chronological record of all relevant transactions. This provides regulators with a perfect, provable audit trail on demand. It directly solves the data integrity crisis (highlighted by the 40% of CFOs who doubt their own records) by providing a “single source of truth” that cannot be tampered with.

- Active Compliance (Smart Contract Automation): This is the revolutionary step. We use smart contracts to write your business logic and regulatory rules directly into the code. This is compliance automation. It fundamentally transforms your compliance posture from reactive (a manual audit of last quarter’s data) to proactive (real-time enforcement). A transaction that violates a SOX rule, a data request that breaches HIPAA, or a payment that fails a KYC/AML check is prevented from executing in the first place. This flips compliance from a “cost center” to a “competitive advantage” by drastically reducing risk, fraud, and audit costs.

3. Scalability: Enabling Mass Adoption via Hybrid Architecture

We know that the “scalability trilemma”—the fact that most blockchains can’t be fast, secure, and decentralized at the same time—has been a “persistent roadblock” to enterprise adoption. Your high-demand environments in finance and logistics cannot tolerate slow, congested, high-fee networks.

Our solution to this scalability problem is our hybrid architecture.

We are experts in Layer-2 (L2) solutions and off-chain processing. By design, our architecture processes your high-volume transactions off-chain (either on a high-speed L2 or within your own legacy system). Only the final, verified proofs or settlements are “batched” and anchored to the main L1 blockchain for immutability.

This reveals the critical synergy of our model: scalability is not a separate feature we add on; it is a fundamental outcome of our privacy-first hybrid architecture.

The very same mechanism we use to solve your privacy problem (keeping sensitive data off-chain) simultaneously solves your scalability problem (keeping high-volume transactions off-chain). This elegant, “two-for-one” solution is precisely what makes our model viable for enterprise-level deployment, allowing you to handle the massive transaction volumes of banking and healthcare without compromising on security or privacy.

Conclusion – Upgrade Seamlessly with Vinova’s Enterprise Blockchain Integration

Your legacy systems are holding back your blockchain strategy, but a “rip and replace” is not an option.

At Vinova, we specialize in the “add-on” strategy. We build the secure bridge between your existing platforms and modern, trust-based technology—a complex task requiring a rare and specialized skillset.

Our enterprise methodology provides the path. We use middleware as a safe bridge, enterprise frameworks like Hyperledger for control, and hybrid on/off-chain architecture for privacy and speed.

This isn’t just a technical upgrade; it’s a strategic transformation. It’s how you protect your investments while creating a “single source of truth” to innovate with confidence.Contact us to build your integrated foundation and secure your competitive advantage.