Blockchain is revolutionizing the insurance industry. From a modest $64.5 million in 2018, the global blockchain in insurance market is projected to reach $1.39 billion by 2023, with a CAGR of 84.9%.

In insurance, blockchain offers transparency, security, and efficiency, enabling streamlined processes and reduced fraud. This technology is poised to transform the way insurance policies are issued, claims are processed, and trust is built within the industry.

Table of Contents

Introduction to Blockchain in Insurance

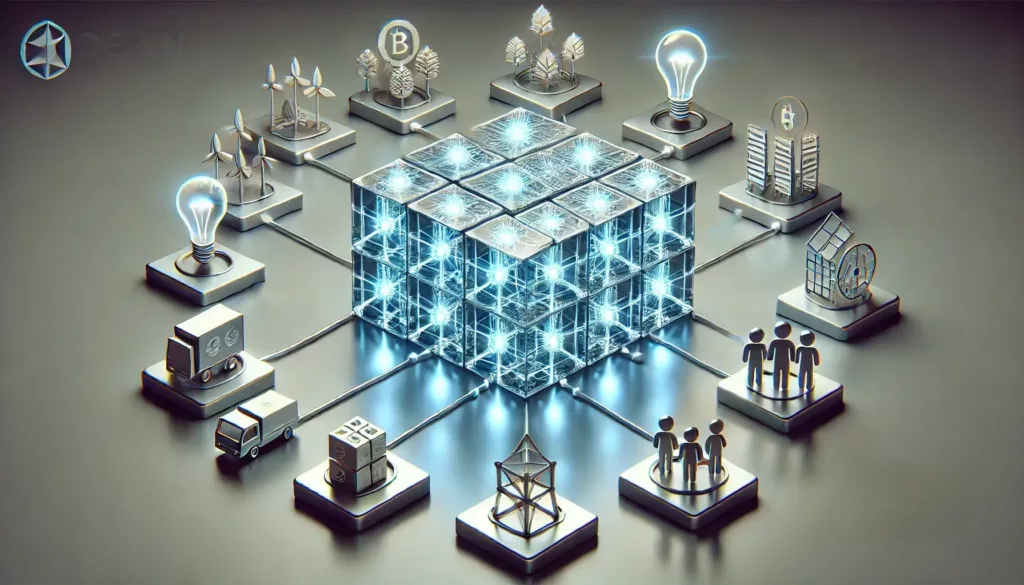

Blockchain consulting services, initially known for its role in cryptocurrencies like Bitcoin, is now being adopted by various industries, including insurance. This decentralized and immutable digital ledger offers significant benefits to the insurance sector, including:

- Transparency: Blockchain provides a transparent record of transactions, enhancing trust between insurers and policyholders.

- Efficiency: By streamlining processes and reducing paperwork, blockchain can improve operational efficiency and reduce costs.

- Security: Blockchain’s secure and tamper-proof nature helps prevent fraud and ensure data integrity.

By leveraging blockchain in insurance technology, insurance companies can modernize their operations, improve customer experiences, and gain a competitive edge.

Benefits of Blockchain in Insurance

Blockchain technology offers several significant advantages for the insurance industry, including:

- Transparency and Trust: Blockchain ensures transparency by allowing all parties involved in a transaction to access the same data. This fosters trust and reduces the risk of fraud.

- Reduced Fraud: The immutability of blockchain records makes it more difficult to commit fraudulent claims, reducing the financial burden on insurance companies.

- Efficiency: By streamlining processes and automating workflows, blockchain can improve operational efficiency and reduce costs.

- Cost Savings: Blockchain can help insurers reduce administrative costs by eliminating intermediaries and reducing paperwork.

These benefits make blockchain in insurance a compelling technology for insurers seeking to modernize their operations and improve their competitiveness.

9+ Use Cases of Blockchain in Insurance

By examining specific use cases and their potential benefits, we can gain a better understanding of how blockchain is transforming the way insurance is conducted. Let’s explore some practical applications of blockchain in insurance:

Smart Contracts for Claims:

Smart contracts are self-executing contracts with terms directly written into code. Smart contract insurance means automating claims processing, reducing administrative overhead, and accelerating payouts.

How Blockchain Supports Smart Contracts:

- Decentralization: Blockchain eliminates the need for a central authority, ensuring trust and transparency in the claims process.

- Security and Encryption: Blockchain’s cryptographic techniques protect data and prevent tampering with smart contracts.

- Immutable Ledger: The immutable nature of blockchain provides a permanent record of claims data, preventing fraud and ensuring transparency.

- Automated Execution: Smart contracts automatically execute when predefined conditions are met, streamlining claims settlement and reducing manual intervention.

Benefits of Using Smart Contract Insurance:

- Faster Claims Processing: Smart contracts can significantly reduce the time it takes to process and settle claims.

- Reduced Costs: By automating processes and eliminating manual intervention, smart contracts can help insurers reduce administrative costs.

- Enhanced Efficiency: Smart contracts can improve operational efficiency and improve customer satisfaction.

Real-World Example: Allianz Catastrophe Swap Transactions

Allianz has successfully piloted a blockchain-based smart contract solution for automating catastrophe swap transactions. This demonstrates the practical application of smart contracts in the insurance industry and highlights the potential benefits in terms of efficiency and cost savings.

Proof of Insurance:

Blockchain technology offers a revolutionary solution for proof of insurance (PoI). By storing insurance information on a decentralized ledger, blockchain enables real-time verification, eliminates the need for physical documents, and enhances security.

Key Benefits of Blockchain-Based PoI:

- Digital Verification: Easily verify insurance coverage using a smartphone and a QR code.

- Immutable Records: Blockchain ensures that insurance records are tamper-proof and cannot be altered.

- Privacy and Transparency: Only relevant information is shared, protecting personal privacy while maintaining transparency.

- Efficiency: Streamlines the process of verifying insurance coverage, reducing hassle for both policyholders and law enforcement.

Real-World Applications:

- Traffic Stops: Quickly verify insurance coverage during traffic stops, eliminating the need for physical documents.

- Accidents: Exchange insurance information seamlessly with other drivers involved in accidents.

- Rental Cars: Provide proof of insurance for rental car companies quickly and efficiently.

Parametric Insurance:

Parametric insurance is a type of insurance where payouts are triggered based on predefined events, such as weather conditions or market fluctuations. Blockchain technology enhances parametric insurance by:

- Ensuring Transparency: Blockchain provides a transparent record of the predefined triggers and their occurrence, ensuring that payouts are based on objective data.

- Automating Claims Settlement: Smart contracts can automatically trigger payouts when predefined conditions are met, streamlining the claims process and reducing administrative costs.

- Providing Faster Relief: Parametric insurance powered by blockchain offers faster payouts to policyholders, providing timely financial assistance in times of need.

Real-World Examples:

- Weather-Indexed Crop Insurance: Farmers can receive compensation if weather conditions deviate from the norm, ensuring financial stability in the face of adverse weather events.

- Flight Delay Insurance: Travelers can receive automatic compensation for flight delays, eliminating the need for manual claims processing.

Subrogation:

Subrogation is the process by which an insurer seeks to recover costs from a liable third party. Blockchain technology can significantly streamline and improve the subrogation process by:

- Automated Tracking and Verification: Blockchain creates an immutable record of the entire claims process, ensuring transparency and reducing the risk of disputes.

- Smart Contracts for Settlements: Smart contracts can automate the settlement process, reducing manual intervention and accelerating the recovery of costs.

- Reduced Administrative Burden: Blockchain can streamline the subrogation process, reducing paperwork and administrative overhead.

Real-World Example:

In the case of property damage caused by a negligent neighbor, blockchain can be used to track the incident, record the payments made, and facilitate the subrogation process. This transparency and efficiency can help insurers recover costs more quickly and effectively.

Identity Verification:

Blockchain technology offers a secure and efficient way to verify customer identities. By leveraging the immutability and transparency of blockchain, organizations can enhance security and prevent fraud.

Key Benefits:

- Enhanced Security: Blockchain’s decentralized nature and cryptographic techniques make it difficult for malicious actors to compromise identity data.

- Reduced Fraud: Blockchain can help prevent identity theft and fraud by providing a secure and verifiable record of identity information.

- Improved Efficiency: Blockchain-based identity verification can streamline processes and reduce the time and cost associated with traditional verification methods.

Use Cases:

- Financial Services: Banks and other financial institutions can use blockchain to verify customer identities, preventing fraud and ensuring compliance with regulations.

- Government Services: Governments can leverage blockchain for secure citizen identification and verification, improving the efficiency of public services.

- Supply Chain Management: Blockchain can be used to track and verify the identities of parties involved in supply chains, ensuring transparency and authenticity.

Reinsurance:

Reinsurance is a risk management strategy where insurers transfer a portion of their risk to other insurers (reinsurers). Blockchain technology can significantly enhance the reinsurance process by:

- Ensuring Transparency: Blockchain creates an immutable record of reinsurance contracts, claims, and settlements, fostering trust and reducing disputes.

- Automating Settlements: Smart contracts can automate the settlement process, streamlining workflows and accelerating payouts.

- Improving Risk Assessment: Blockchain enables insurers to share data and conduct more accurate risk assessments, leading to fairer pricing and more sustainable risk management.

Real-World Example:

In the event of a hurricane, insurers can leverage blockchain to automatically trigger reinsurance payments based on predefined terms and conditions. This ensures timely payouts and reduces the administrative burden associated with traditional reinsurance processes.

Healthcare Claims:

Blockchain health insurance technology offers significant benefits for the healthcare insurance industry, including:

- Streamlined Claims Processing: Smart contracts can automate claims processing, reducing manual intervention and accelerating payouts.

- Immutable Records: Blockchain ensures that healthcare records are tamper-proof, providing transparency and preventing fraud.

- Fraud Detection and Prevention: The transparency of blockchain can help identify and prevent fraudulent claims, reducing costs for insurers and ensuring fairness for honest policyholders.

Real-World Example:

Blockchain health insurance can be used to streamline the medical billing process. When a patient visits a specialist, the doctor can submit the claim to the insurer. The blockchain can then verify coverage, process the payment, and record the transaction securely and transparently. This eliminates the need for manual processing and reduces the risk of errors or disputes.

Title Insurance:

Blockchain can authenticate property titles, preventing fraud and reducing paperwork.

Blockchain technology offers significant benefits for the title insurance industry:

- Ownership Authentication: Blockchain enables real-time access to property ownership information, ensuring transparency and security.

- Cost Reduction: By streamlining the process of accessing ownership records, blockchain can reduce the costs associated with traditional title searches.

- Fraud Prevention: The immutability of blockchain records makes it difficult to alter or tamper with property titles, preventing fraudulent transactions.

- Efficiency: Blockchain streamlines the title production process, reducing the time and effort required to verify ownership.

Real-World Example:

When buying a house, blockchain can be used to quickly and efficiently verify the property’s ownership history. This eliminates the need for lengthy title searches and reduces the risk of fraud or disputes.

Supply Chain Insurance:

Blockchain in supply chain insurance refers to the application of blockchain technology to track and manage the movement of goods and products throughout the supply chain. By leveraging the decentralized and immutable nature of blockchain, insurers can enhance transparency, reduce fraud, and improve efficiency.

Blockchain technology offers significant benefits for supply chain insurance:

- Provenance Tracking: By recording every step of a product’s journey on the blockchain, insurers can gain real-time visibility into the supply chain and accurately assess risks.

- Risk Assessment and Claims Handling: Smart contracts can automate claims processing, reducing paperwork and accelerating settlements.

- Fraud Prevention: Blockchain’s transparency and immutability make it difficult to manipulate data or commit fraudulent activities.

Real-World Example:

Blockchain can be used to track high-value cargo shipments, ensuring transparency and preventing fraudulent activities. By recording each checkpoint in the supply chain, insurers can verify the authenticity of goods and streamline the claims process.

Challenges and Limitations of Blockchain in Insurance

While blockchain technology offers significant potential for the insurance industry, it’s important to acknowledge the challenges and limitations that need to be addressed:

Scalability:

- Challenge: Ensuring that blockchain networks can handle a large volume of transactions efficiently is crucial for widespread adoption.

- Impact: Scalability issues can hinder the performance of insurance applications and impact user experience.

- Solutions: Researchers and developers are actively working on solutions such as sharding and layer-2 protocols to improve scalability.

Regulatory Uncertainty:

- Challenge: The lack of clear regulatory frameworks for blockchain can create uncertainty and hinder adoption.

- Impact: Regulatory ambiguity can make it difficult for insurers to navigate the legal and compliance landscape.

- Solutions: Collaborative efforts between industry stakeholders, regulators, and legal experts are essential to develop clear guidelines and standards.

Integration Complexity:

- Challenge: Integrating blockchain technology with existing insurance systems can be complex and costly.

- Impact: Legacy systems may not be compatible with blockchain, requiring significant changes and investments.

- Solutions: Interoperability standards and well-defined APIs can facilitate integration between blockchain and existing systems.

Real-World Considerations Of Potential Insurance Blockchain Projects:

- Balancing Innovation and Pragmatism: Insurers must carefully evaluate the potential benefits of blockchain against the costs and complexities of implementation.

- Pilots and Proofs of Concept: Conducting pilot programs and proofs of concept can help insurers assess the feasibility and benefits of blockchain technology.

- Collaboration and Education: Industry collaboration and education are essential for fostering understanding and adoption of blockchain technology.

Predictions for Blockchain Evolution in the Insurance Sector

As blockchain technology continues to mature and demonstrate its value, we can expect to see increased adoption across the insurance industry and Blockchain insurance companies.

Key Trends and Predictions:

As blockchain technology continues to mature and demonstrate its value, we can expect to see increased adoption across the insurance industry. According to recent estimates, approximately 60% of insurance companies are already investing in blockchain solutions. This trend is expected to accelerate, with insurers integrating blockchain into various aspects of their operations, from claims management to policy issuance.

Example: A leading insurance company has successfully implemented a blockchain-based platform to streamline its claims processing operations. This has resulted in significantly reduced turnaround times and improved customer satisfaction. A result that can be replicated for other blockchain insurance companies.

Interoperability:

A growing number of insurance companies are adopting blockchain technology. According to the Accenture Technology Vision 2019 survey, over 80% of insurance executives reported using or planning to pilot distributed ledger technology (DLT) in their organizations.

This trend reflects the increasing recognition of blockchain’s potential to transform the insurance industry. As adoption grows, we can expect to see greater interoperability between different blockchain networks. This will enable seamless data sharing and collaboration, fostering innovation and efficiency.

Example: A consortium of insurance companies has formed a blockchain-based platform to share data on policyholders, claims, and risk assessments. This collaboration improves underwriting accuracy, reduces fraud, and enhances the overall efficiency of the insurance ecosystem.

Innovative Use Cases:

The global market for blockchain in insurance is expected to grow from $64.5 million in 2018 to an impressive $1.39 billion by 2023—a compound annual growth rate of 84.9%. This will propel the development of new insurance products and services, such as parametric insurance for climate-related risks and microinsurance for underserved populations.

Example: An insurance company offers parametric crop insurance, where payouts are triggered based on objective weather data stored on a blockchain.

Collaboration and Consortia:

Industry collaboration is essential for the successful adoption of blockchain technology in insurance. Consortia and partnerships between insurers, technology providers, and regulators can drive standardization, best practices, and regulatory frameworks.

Example: Blockchain Insurance Industry Initiative (B3i): Among Insurance blockchain projects, the Blockchain Insurance Industry Initiative (B3i) is a prominent consortium focused on driving the adoption of blockchain technology in the insurance industry. Founded in 2016, B3i brings together over 40 member organizations to develop innovative blockchain solutions, establish industry standards, and facilitate collaboration among industry stakeholders.

Real-World Considerations:

- Regulatory Agility: Insurers will need to adapt to evolving regulatory frameworks and navigate the legal landscape. Insurance companies actively participate in industry forums and work with regulators to develop clear guidelines for blockchain adoption.

- Balancing Legacy Systems and Innovation: Insurers will likely adopt a hybrid approach, integrating blockchain technology into their existing systems while maintaining stability and functionality. An insurer integrates a blockchain-based solution for underwriting processes while retaining its legacy claims management system.

The future of blockchain in insurance is promising, with the potential to transform the industry through increased efficiency, transparency, and innovation. By embracing blockchain, insurers can improve customer experiences, reduce costs, and stay ahead of the competition.

Conclusion

Blockchain technology presents a transformative opportunity for the insurance industry. Its potential to streamline processes, enhance transparency, and improve the overall experience is undeniable.

While navigating this new landscape requires collaboration, the benefits are significant. By embracing innovation, the insurance industry can build a more efficient, secure, and future-proof ecosystem.

Stay tuned for future posts exploring specific use cases and industry developments. Share your thoughts and questions in the comments below – let’s keep the conversation going!